This article is the first in a series drawn from Ben’s latest global macroeconomic outlook, Geographic Diversification in Private Equity Markets, developed and written in partnership with Oxford Economics.

The interplay between broad macroeconomic conditions and returns in global private financial markets is capricious, with everything from policy changes to environmental factors capable of creating a significant impact. Still, private markets continue to attract record capital inflows as investors seek to make the most of the higher returns those markets may provide in a challenging economic environment. Despite the economic damage wrought by the pandemic, 2020 saw a record $73.6 billion raised in the U.S. for venture capital and a respectable $203 billion for private equity.

An environment of abundant liquidity and high valuation may last, particularly if policy makers are forced to provide more support. However, this will place a strong emphasis on minimizing investment risk and diversifying portfolios. In Ben’s last white paper, we demonstrated the importance of looking across private asset classes rather than relying on fund selection. In 2022, we narrow our focus to examine how private markets are changing to accommodate a world in flux.

The Rise of Global Liquidity

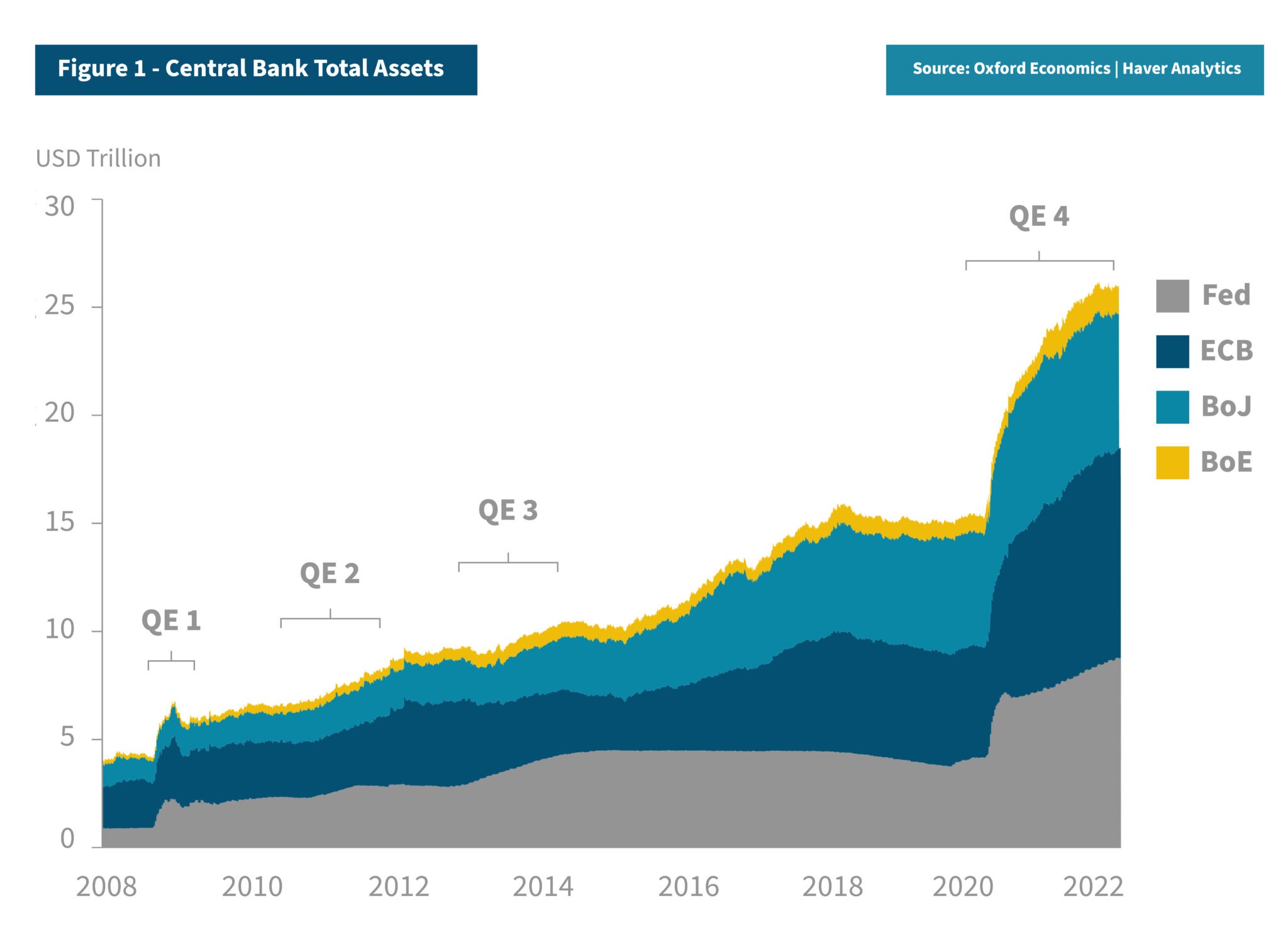

Fundamentally, these venture capital and private equity inflows reflect soaring global liquidity as central banks and governments adopt ultra-accommodative policies to combat the impact of the pandemic (Figure 1).

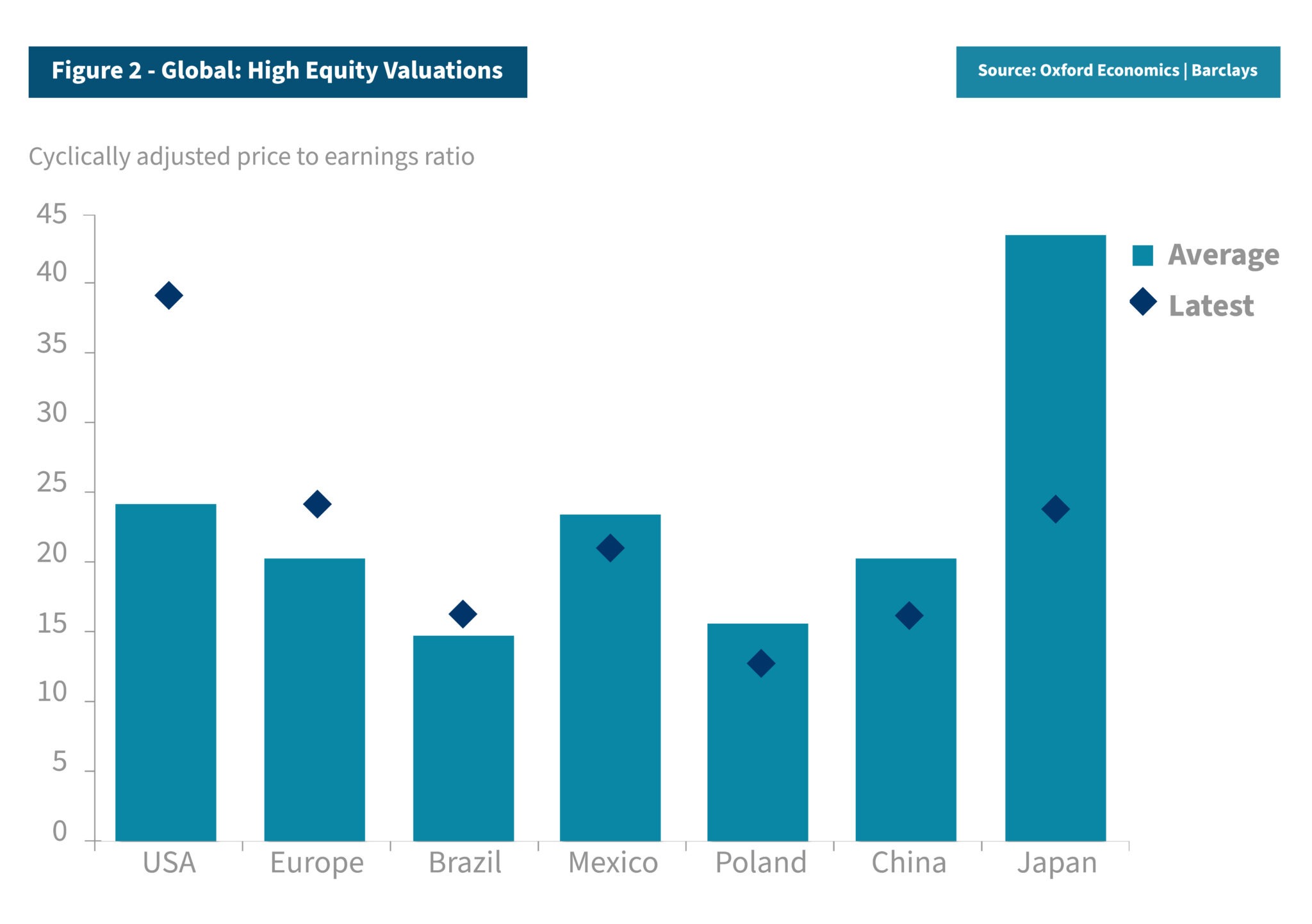

The balance sheets of the four largest central banks have expanded by around $11 trillion during the crisis, indirectly helping to finance swelling government deficits. As with any period of abundant liquidity, more funds are chasing relatively few assets, which has resulted in lofty valuations in both private and public equity markets (Figure 2).

Although the experience of the pandemic − and the global financial crisis before that − has been one of synchronized global downturns, there are good reasons to expect an uneven recovery across the global economy, including differing levels of policy support, vaccination rates and exposure to vulnerable sectors (such as tourism).

Extended Inflation and Private Markets

Similarly, the medium-term outlook for inflation (usually damaging for equity returns) could be materially different across regions. In the U.S., where fiscal support for the economy has been significantly larger than anywhere else in the global economy, an extended period of high inflation is a greater risk. Such a period of high inflation could be bad for asset returns, possibly prompting investors to think twice before continuing to allocate heavily to U.S. markets.

Private market investors are cognizant of these realities. Private capital allocation is beginning to become more diversified, with the traditional destinations of the U.S. technology sector seeing its share of venture capital funding falling to the lowest in a decade at 22.7%.2 With the U.S. widely regarded as the most attractive country for private equity investors 3 for a wide range of practical reasons, including depth of capital markets and prevalence of opportunities, the case for geographical diversification is likely to be nuanced alongside other investment goals such as liquidity, returns and ease of access.*

Conclusion

In summary, investors in private markets can benefit from geographic diversification to help minimize their specific market downside risks, to participate in global economic growth, as well as to reduce their exposure to inflation risks and stretched valuations. Investors are starting to take notice, with allocations to traditional U.S. based private markets showing signs of decline.

Trust Ben™

At Ben, we have crafted a suite of reliable, ongoing liquidity solutions for investors in alternative assets. Our process seeks to give investors access to hard-earned investment capital, with liquidity provided from our own balance sheet. Contact us today to schedule a consultation with our expert team.

1 PitchBook, https://explodingtopics.com/blog/vc-trends

2 PitchBook, https://explodingtopics.com/blog/vc-trends

3 https://blog.iese.edu/vcpeindex/

*The information in this material is not intended to replace any information or consultation provided by a financial advisor or other professional nor shall be perceived to constitute financial, legal, accounting or tax advice. The views and opinions expressed are those of the panelists and do not necessarily reflect the official policy or position of Ben or Oxford Economics. The information in this material is not intended to replace any information or consultation provided by a financial advisor or other professional nor shall be perceived to constitute financial, legal, accounting or tax advice.

These materials contain certain estimates, projections and forward-looking statements that contain substantial risks and uncertainties. The estimates, projections and forward-looking statements contained herein may or may not be realized, accurate or complete, and differences between estimated results and those realized may be material. Such estimates, projections and forward-looking statements are illustrative only and reflect various assumptions of Ben’s management concerning the future performance of Ben and its affiliates, and are subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond Ben’s control.

Except as otherwise noted, the materials speak as of January 2022. Neither Ben nor any of its affiliates or representatives undertakes any obligation to update or revise any of the information contained herein or to correct any inaccuracies which may become apparent.

Download the full Geographic Diversification in Private Equity Markets white paper above or contact us today to discuss what Ben’s secondary market liquidity solutions could mean for you.

CONTACT INFO

CALL: 888.887.8786

EMAIL: askben@beneficient.com