Ben’s Underwriting Team, much like the company itself, has set its sights on democratizing the ability for all alternative asset investors to be able to access liquidity options in a cost effective and efficient manner. While individual investors and small-to-mid-sized institutions are the fastest growing investor segment of the alternative asset market, before Ben’s solutions, this segment had no access to cost effective, efficient liquidity options when they wanted to rebalance their portfolios.

Typical secondary transactions usually involve complex and lengthy processes to arrive at a valuation for the assets an investor wants to sell. Combine this with differing liquidity needs and goals for individual investors, and you are left with a subset of investors who are not well served by traditional secondary funds. This is where Ben comes in.

To provide a modern way of accessing liquidity options, Ben has created innovative technology-driven systems and digital customer interfaces within an end-to-end transaction process that is subject to regulatory oversight. To support this approach, Scott Wilson, Ben’s Chief Underwriting Officer, has built the Underwriting Team as a nimble investment group that understands, values, and assesses a vast array of alternative assets, while continuously developing new tools and approaches to make Ben’s liquidity options even more rapid, simple, and cost-effective.

Doing so helps support the company’s overall mission by offering customers a different way of doing business than what has traditionally been available in the secondaries market. Through Ben’s differentiated approach and structure, which allows for a faster timeline for investors, the Underwriting Team can provide more options to more investors – even those with smaller investments – across a broader spectrum of assets.

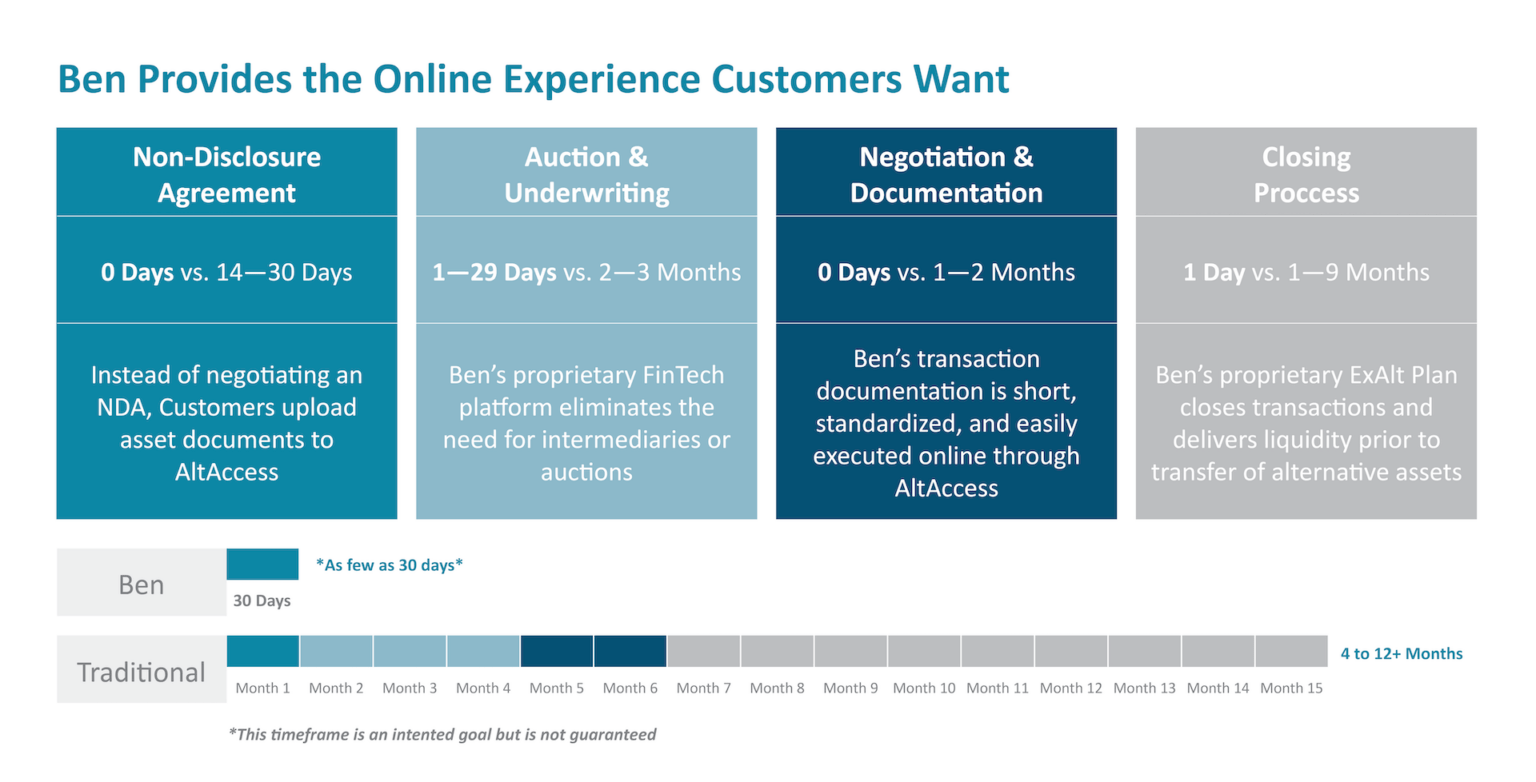

This is made possible by leveraging proprietary processes and technologies like Ben AltAccess™, a digital platform that allows alternative asset investors to pursue liquidity options, and Ben AltQuote™, Ben’s novel tool expected to launch shortly that provides customers with access to quick, online quotes for their alternative assets. These tools, combined with Ben’s unique approach to underwriting, allow Ben to potentially deliver liquidity to its customers in as short as 30 days or less.

In a recent interview, Scott discussed Ben’s underwriting process and what sets it apart from other liquidity and secondaries market participants.

Building Ben’s Underwriting Team

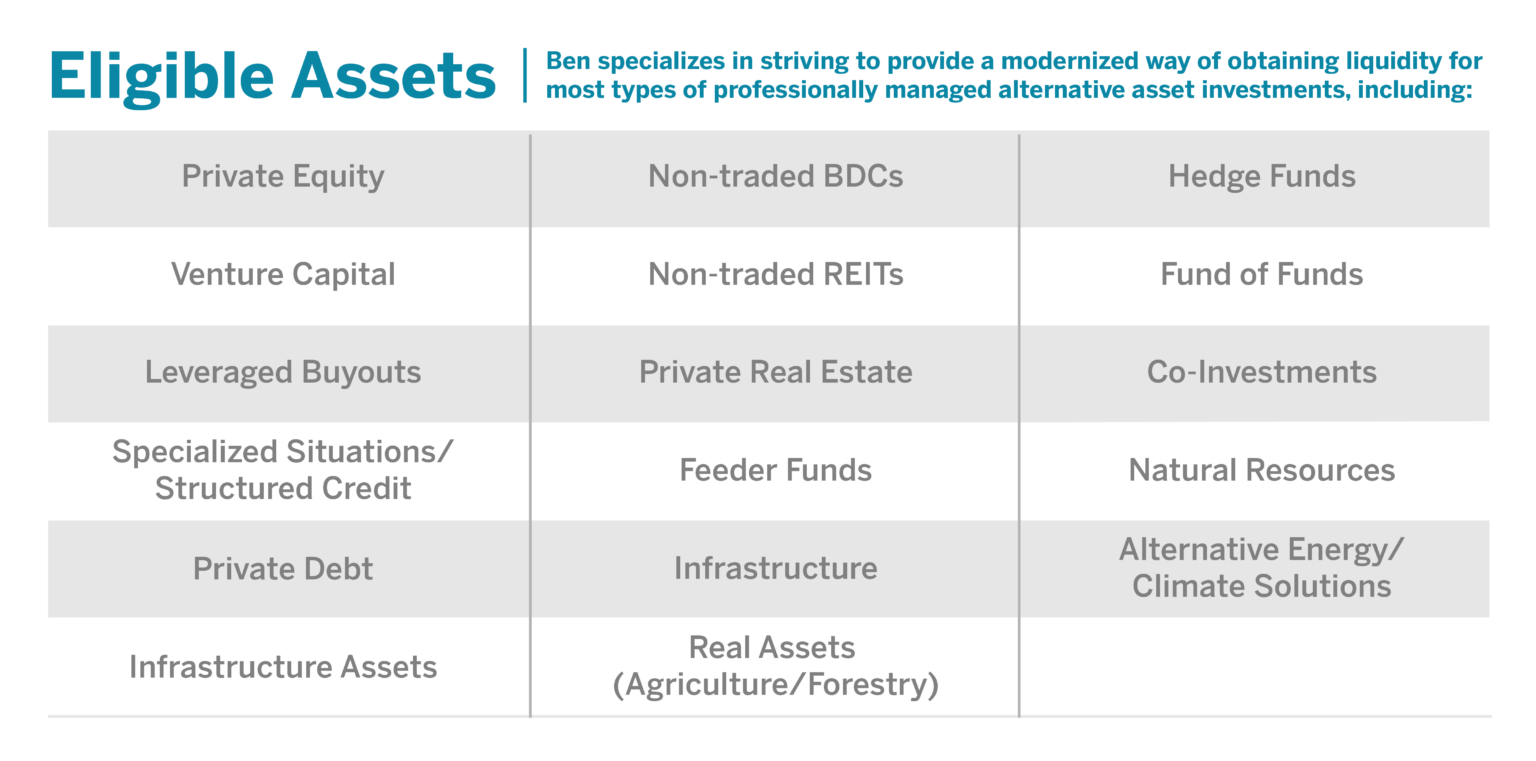

When I joined Ben four years ago, I had the opportunity to create an underwriting team that could provide meaningful, differentiated value for customers seeking liquidity from their alternative assets. While the traditional secondary market plays a critical role in our industry, Ben specializes in providing a technology driven, modernized way of obtaining liquidity options for most types of professionally managed alternative assets.

Even in our young history, as Ben worked to fully launch, the company has transacted over $1 billion in Net Asset Value, working directly with high-net-worth investors and small-to-mid-sized institutions, as well as partnering with several general partners to address solutions for their entire funds. Ben recognized a large, unmet need from individual investors and small-to-mid sized institutions looking to unlock the value of their alternative asset holdings but lacked the time, resources, buyer attention to achieve liquidity – or even the knowledge that such opportunities are possible.

Ben’s Approach to Alternative Asset Liquidity

A major differentiator for Ben is our ability to provide liquidity options at scale. While leading secondary funds will seek to complete on average 50 or fewer large transactions worth hundreds of millions or billions annually, Ben seeks to complete hundreds, if not thousands, of smaller-sized liquidity transactions in that same timeframe for a variety of professionally managed alternative assets, greatly expanding opportunities for a much wider group of alternative asset investors.

Ben’s technology-driven, scalable approach can offer simple, rapid, and cost-effective liquidity options to our customers for several reasons:

Ben’s technology-driven, scalable approach can offer simple, rapid, and cost-effective liquidity options to our customers for several reasons:

First, Ben simplifies the liquidity process from the start by allowing customers to initiate, manage, and complete their request for liquidity online through the industry’s first secure customer portal, AltAccess. Within AltAccess, customers receive and complete our short-form standardized agreement and transaction documents. This simplified, consistent process allows us to eliminate significant time usually spent on document negotiation and delivery, a process that alone can take up to over 60 days with traditional secondary funds, not to mention the time and cost required to secure outside legal counsel as is typically done in traditional processes. Such costly legal expenses can also be avoided thanks to Ben’s unique, technology-enabled AltAccess solution. Our customers’ safety, soundness, and security operate at the forefront of every decision we make.

Next, through Ben’s proprietary technology and systems, we can expedite the valuation and proposal process thanks to our method that incorporates both top-down and bottom-up valuation assessments. This process was designed by our experienced Investment Team members in conjunction with Ben’s Portfolio Allocation and Risk Team, and with additional oversight and guidance from Ben’s Board of Directors’ Credit Committee, which includes two former Federal Reserve Bank Presidents. Our approach leverages both broad market categorizations and macroeconomic data with fundamental assessments at the fund and individual investment levels, which helps Ben strive to deliver liquidity options at fair prices.

Finally, Ben is a permanent operating company that uses its own balance sheet. This is a critical differentiator because it means there is no ticking clock or fund termination date which allows us to take a long-term view and provide liquidity options on a wide array of eligible assets. As a result, customers can expect a positive experience as we strive to deliver attractive liquidity options quickly for most alternative assets.

Finally, Ben is a permanent operating company that uses its own balance sheet. This is a critical differentiator because it means there is no ticking clock or fund termination date which allows us to take a long-term view and provide liquidity options on a wide array of eligible assets. As a result, customers can expect a positive experience as we strive to deliver attractive liquidity options quickly for most alternative assets.

A common outcome in the traditional secondary market is that investors may only achieve partial solutions to their liquidity needs – i.e., not all of their assets can be liquidated. Ben’s ability to be a provider of liquidity options to a diverse universe of alternative investments also supports our mission to maintain a diversified portfolio that is more naturally insulated from overconcentration toward any given subsector or asset class.

For more detail on Ben’s innovative approach to building and managing a diversified portfolio of alternative assets, please see our 2022 Global Macroeconomic Outlook as well as our Total Portfolio Management (TPM) blog.

Continuously Improving Our Underwriting Process

Another key component of our Underwriting Team is our approach to continuous improvement. At our core, the Underwriting Team has two mandates: 1) review and provide options for all of our customers with the tools we have available today, and 2) regularly improve our processes to meet the evolving needs of our company, our customers, and the industry by seeking ways to use technology, algorithms, and data to price more quickly and accurately.

By being customer-centric and focusing on the needs of individual investors and small-to-mid sized institutional investors, Ben has – and must continue to – design its structure and operations to create efficiency, scale, and speed in a market that traditionally has seen little of each. Within my team specifically, we must always optimize and develop new processes by leveraging the troves of data we gain from our ever-growing portfolio of assets.

For example, if our team is using the same tools and processes as they exist today in two years, then I believe we have failed. Not because our processes today are inadequate, but because there is so much more we will be doing with the superior technology and volume of data we have at our fingertips when combined with the regulatory and structural advantages of Ben’s solutions. With our unique expertise, I believe Ben will be a leader in providing liquidity options and will continue to meet a critical demand for investors that have been underserved by traditional secondary funds for years.

Trust Ben™

At Ben, we have crafted a suite of reliable, ongoing liquidity solutions for investors in alternative assets. Our process seeks to give investors access to hard-earned investment capital, with liquidity provided from our own balance sheet. Contact us today to schedule a consultation with our expert team.

Disclaimer

Subject to Qualifications

These materials are provided for illustration and discussion purposes and are not intended to be and do not constitute financial, tax, legal, or investment advice or recommendations, an offer to sell or exchange, or the solicitation of an offer to buy or exchange, any securities. Securities brokerage services are offered through Beneficient Securities Company L.P. (“Ben Securities”), which may provide certain materials to recipients. Ben Securities is affiliated with Beneficient, a Nevada corporation, and/or any of its affiliates, subsidiaries, and successors (collectively, “Ben”) and is a broker-dealer registered with the Securities and Exchange Commission and various states and a Member FINRA/SIPC. Investments involve risks and are not suitable for all persons.

Scott Wilson, Chief Underwriting Officer

Read Scott’s bio on our team page.