Maintained Cost-Efficient Operating Profile

New Machine-Automated Pricing System Enhances Portfolio Growth Capabilities in Support of Multibillion Dollar Liquidity and Primary Capital Product Launch

Dallas, TX. – August 14, 2024 (GlobeNewswire) – Beneficient (NASDAQ: BENF) (“Ben” or the “Company”), a technology-enabled financial services holding company that provides liquidity and related trust and custody services to holders of alternative assets, today reported its financial results for the fiscal 2025 first quarter, which ended June 30, 2024.

Commenting on the fiscal 2025 first quarter results, Beneficient management said: “Our financial results improved on a sequential basis resulting in our first profitable quarter as a public company. We continue to position Ben as the leading solution for liquidity and primary capital in large and growing private investment markets and are now seeking to further build on this success through a growing pipeline of general partners and other investors interested in our Preferred Liquidity Provider Program, offered through our GP Solutions group. By executing on these opportunities, we believe our investors can benefit from both the services we provide as well as the underlying performance of our assets held in trust, which include some of the most exciting and sought-after names in private equity. In support of this effort, Ben’s Board of Directors has authorized the ExchangeTrust Product Plan of up to $5 billion of fiduciary financings to Customer ExAlt Trusts through ExchangeTrust transactions using an automated pricing system.

“The recently announced integration of our machine-automated pricing systems (also known as “MAPS”) into AltAccess, Ben’s automated, efficient and transparent fintech platform, is intended to enable the rapid processing of a higher volume of liquidity and primary capital transactions. We expect MAPS will allow the timeframe for these transactions to be reduced from more than 15 months with traditional underwriting to now as little as 15 days. Concurrent to the launch of MAPS, we have now re-entered the market with a dedicated sales, marketing, and advertising campaign intended to create new product activity with our prospective customers based on our MAPS capabilities.”

First Quarter Fiscal 2025 and Recent Highlights (for the quarter ended June 30, 2024 or as noted):

- Reported investments with a fair value of $331.4 million, up from $329.1 million at the end of our prior fiscal year, served as collateral for Ben Liquidity’s net loan portfolio of $255.9 million and $256.2 million, respectively.

- Maintained the GP Preferred Liquidity Provider Program at 20 funds and $1.5 billion in committed capital compared to 7 participating funds with $300 million in committed capital at December 31, 2022.

- Revenues were $10.0 million in the first quarter of fiscal 2025 as compared to $(2.7) million in the same quarter of fiscal 2024.

- Operating expenses contributed to profitability by being $(34.3) million, due to the release of a loss contingency accrual of $55.0 million and a non-cash goodwill impairment of $3.4 million, as compared with 1Q24 operating expenses of $1,153.2 million, which included a non-cash goodwill impairment of $1,096.3 million.

- Excluding the non-cash goodwill impairment and the loss contingency accrual release in each period, as applicable, operating expenses were $17.3 million in the first quarter of fiscal 2025 as compared to $56.9 million in the same period of fiscal 2024.

- Entered into a Purchase Agreement with YA II PN, Ltd. (“Yorkville”), pursuant to which the Company agreed to issue and sell Yorkville convertible debentures issuable in the aggregate principal amount of $4.0 million and warrants to purchase up to 1,325,382 shares of the Company’s Class A common stock at an exercise price of $2.63.

- Announced court ruling to vacate the previously disclosed arbitration award against the Company in the aggregate amount of approximately $55.3 million in compensatory damages, including pre-judgment and post-judgement interest.

Loan Portfolio

As a result of executing on our business plan of providing financing for liquidity, or early investment exits, for alternative asset marketplace participants, Ben organically develops a balance sheet comprised largely of loans collateralized by a well- diversified alternative asset portfolio that is expected to grow as Ben successfully executes on its core business.

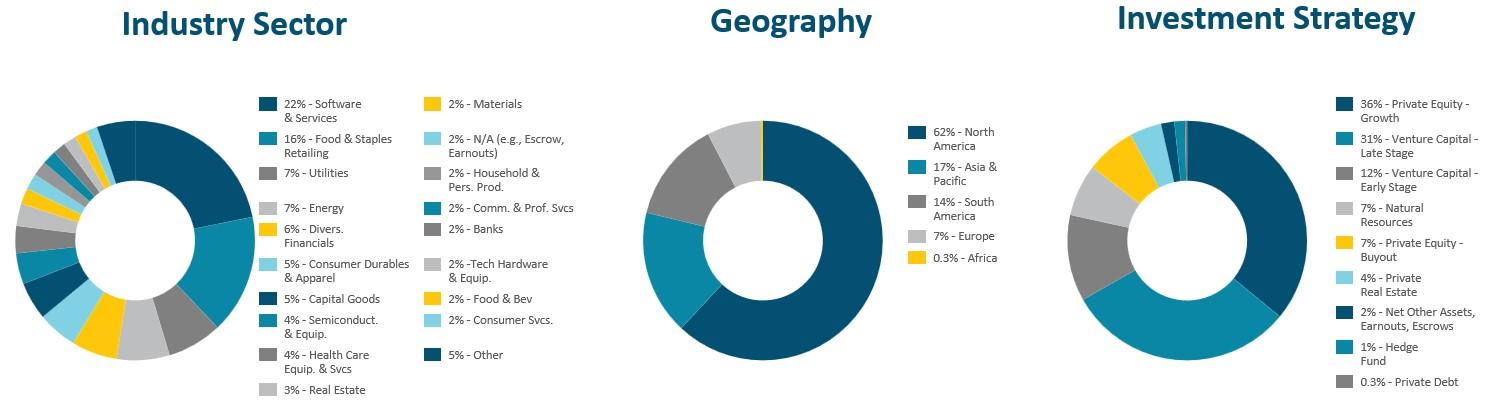

Ben’s balance sheet strategy for ExAlt Loan origination is built on the theory of the portfolio endowment model for the fiduciary financings we make by utilizing our patent-pending computer implemented technologies branded as OptimumAlt. Our OptimumAlt endowment model balance sheet approach guides diversification of our fiduciary financings across seven asset classes of alternative assets, over 11 industry sectors in which alternative asset managers invest, and at least six countrywide exposures and multiple vintages of dates of investment into the private funds and companies.

As of June 30, 2024, Ben’s loan portfolio was supported by a highly diversified alternative asset collateral portfolio providing diversification across more than 250 private market funds and approximately 830 investments across various asset classes, industry sectors and geographies. This portfolio includes exposure to some of the most exciting, sought after private company names worldwide, such as the largest private space exploration company, an innovative software and payment systems provider, a venture capital firm investing in waste-to-energy and clean energy technologies, a technology company providing Net Zero solutions in the production of advanced biofuels, a designer and manufacturer of shaving products, a large online store for women’s clothes and other fashionable accessories that has announced intentions to go public, a mobile banking services provider, and others.

Figure 1: Portfolio Diversification

Diversification Using Principal Loan Balance, Net of Allowance for Credit Losses

As of June 30, 2024, the charts below present the ExAlt Loan portfolio’s relative exposure by certain characteristics (percentages determined by aggregate fiduciary ExAlt Loan portfolio principal balance net of allowance for credit losses, which includes the exposure to interests in certain of our former affiliates composing part of the Fiduciary Loan Portfolio).

As of June 30, 2024. Represents the characteristics of professionally managed funds and investments in the Collateral (defined as follows) portfolio. The Collateral for the ExAlt Loans in the loan portfolio is comprised of a diverse portfolio of direct and indirect interests (through various investment vehicles, including, limited partnership interests and private and public equity and debt securities, which include our and our affiliates’ or our former affiliates’ securities), primarily in third-party, professionally managed private funds and investments. Loan balances used to calculate the percentages reported in the pie charts are loan balances net of any allowance for credit losses, and as of June 30, 2024, the total allowance for credit losses was $311 million, for a total gross loan balance of $566 million and a loan balance net of allowance for credit losses of $256 million.

Business Segments: First Quarter Fiscal 2025

Ben Liquidity

Ben Liquidity offers simple, rapid and cost-effective liquidity products through the use of our proprietary financing and trust structure, or the “Customer ExAlt Trusts, ” which facilitate the exchange of a customer’s alternative assets for consideration.

- Ben Liquidity recognized $10.8 million of interest income for the fiscal first quarter, up 1.9% from the quarter ended March 31, 2024, primarily due to a slightly higher carrying value of loan receivables, which was driven by compounding interest, offset by an increase in the allowance for credit losses.

- Operating loss for the quarter was $0.5 million , compared to an operating loss of $29.4 million for the quarter ended March 31, 2024.

- Adjusted operating loss (1) for the quarter was $0.5 million, compared to adjusted operating loss (1) of $29.4 million in the quarter end ed March 31, 2024. The decrease in adjusted operating loss (1) was primarily due to lower credit loss adjustments along with lower non-interest operating expenses offset partially by additional interest expense, including non-cash amortization of deferred financing costs.

Ben Custody

Ben Custody provides full-service trust and custody administration services to the trustees of certain of the Customer ExAlt Trusts, which own the exchanged alternative assets following liquidity transactions in exchange for fees payable quarterly calculated as a percentage of assets in custody.

- NAV of alternative assets and other securities held in custody by Ben Custody during the period was $380.7 million, compared to $381.2 million as of March 31, 2024. The decrease was driven by distributions during the period, offset by unrealized gains on existing assets, principally related adjustments to the relative share held in custody of the respective fund’s NAV based on updated financial information received from the funds’ investment manager or sponsor during the period.

- Revenues applicable to Ben Custody were $5.4 million for the current quarter, compared to $5.6 million for the quarter ended March 31, 2024. The decrease was a result of lower NAV of alternative assets and other securities held in custody at the beginning of the period, when such fees are calculated.

- Operating income for the current qu arter was $1.3 million, compared to an operating loss of $50.0 million for the quarter ended March 31, 2024 . The increase was primarily due to lower non-cash goodwill impairment in the current quarter of $3.1 million as compared to non-cash goodwill impairment of $28.7 million for the quarter ended March 31, 2024. Additionally, in the quarter ended March 31, 2024, we recognized $25.5 million provision for credit losses related to accrued fees collateralized by securities of our former parent company, compared to no such credit losses in the current quarter.

- Adjusted operating income (1) for the current quarter was $4.4 million , up 10%, compared to adjusted operating income (1) of $4.0 million for the quarter ended March 31, 2024 . The increase was primarily due to lower operating expenses offsetting the change in revenue based on lower NAV of alternative assets and other securities held in custody at the beginning of the periods, when such fees are calculated.

Legal Updates

- On July 29, 2024, a Texas State District Court vacated in its entirety a previously disclosed arbitration award against the Company in the aggregate amount of approximately $55.3 million pertaining to a former member of the board of directors of Beneficient Management, L.L.C. who challenged the termination of certain equity awards under two incentive plans. The Company intends to vigorously defend itself should the claimant seek any additional relief.

- On July 1, 2024, the Company and key members of its leadership received termination letters from the SEC advising the Company that the SEC has concluded the investigation related to the Company and Mr. Heppner, Ben’s founder, Chairman, CEO, and a substantial equity owner, and does not intend to recommend an enforcement action by the SEC under the previously issued Wells Notices.

- On May 22, 2024 a Federal Judge in the United States District Court for the Eastern District of Texas ruled in favor of Beneficient, denying the defendant’s motion to dismiss Beneficient’s lawsuit against the Wall Street Journal reporter, Alexander Gladstone, for defamation, noting “the article repeatedly juxtaposes facts and uses provocative language in ways to convey the defamatory gist identified by Plaintiffs” and that Beneficient “repeatedly notified Gladstone of specific factual errors in the article and that Gladstone nevertheless rejected or ignored their corrections to serve his preconceived agenda.” On July 26, 2024, Beneficient filed a motion to add the Wall Street Journal’s publisher, Dow Jones & Co., Inc., as an additional defendant.

Capital and Liquidity

- As of June 30, 2024, the Company had cash and cash equivalents of $4.4 million and total debt of $120.6 million.

- Distributions received from alternative assets an d other securities held in custody totaled $7.2 million for the three months ended June 30, 2024, compare d to $12.0 million for the same period of fiscal 2024.

- Total investments (at fair value) of $331.4 million at June 30, 2024 supported Ben Liquidity’s loan portfolio.

(1) Represents a non-GAAP financial measure. For reconciliations of our non-GAAP measures to the most directly comparable GAAP financial measures and for the reasons we believe the non-GAAP measures provide useful information, see Non-GAAP Reconciliations.